| |

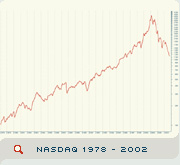

The Most Incredible Bull Market Ever

The bulls called it a "new era in investing",

the bears called it the biggest bubble in history. There is no question

that the bull run the NASDAQ enjoyed in the 1990ies was one of the greatest

- if not the greatest - bull market ever. One has to look back at the

golden 20ies or at the gold rush to find comparably fantastic performance

for investment vehicles in financial history.

The bull market in the NASDAQ exceeded all previous stock booms in a number

of categories:

First,

public participation was broader based than in any previous bull market,

exceeding even the levels of the late 1960ies. First,

public participation was broader based than in any previous bull market,

exceeding even the levels of the late 1960ies.

Second,

valuation levels at the height of the speculation broke all previous records

by a milestone. As a matter of fact, and, incredibly, the bullish comments

between 1997 and 2000 often rationalized the valuation levels because

the companies showed no earnings at all and hence - so the logic - could

not be valued in a traditional way. At its peak the NASDAQ Composite Index

traded at an average price earnings ratio of well over 100, with dividend

yields being non-existent and book values miniscule. Second,

valuation levels at the height of the speculation broke all previous records

by a milestone. As a matter of fact, and, incredibly, the bullish comments

between 1997 and 2000 often rationalized the valuation levels because

the companies showed no earnings at all and hence - so the logic - could

not be valued in a traditional way. At its peak the NASDAQ Composite Index

traded at an average price earnings ratio of well over 100, with dividend

yields being non-existent and book values miniscule.

Third,

the length of the bull run was unprecedented in financial history, exceeding

the wildest and most optimistic expectations. The bull market in

technology stocks lasted for exactly 10 years, with the blow-off phase

lasting an astonishing 3 years. Third,

the length of the bull run was unprecedented in financial history, exceeding

the wildest and most optimistic expectations. The bull market in

technology stocks lasted for exactly 10 years, with the blow-off phase

lasting an astonishing 3 years.

Finally,

the gains seen in the NASDAQ and in individual stocks were un-paralleled.

Percentage gains reached not hundreds but thousands or tens of thousands

of percent. One of the high-flyers, Dell Computer actually rose but over

50,000 percent from 1990 to 2000. Finally,

the gains seen in the NASDAQ and in individual stocks were un-paralleled.

Percentage gains reached not hundreds but thousands or tens of thousands

of percent. One of the high-flyers, Dell Computer actually rose but over

50,000 percent from 1990 to 2000.

As spectacular as the meteoric rise of technology stocks was their decline.

The unwinding of the froth caused many of the celebrated highfliers to

collapse, sometimes in spectacular fashion or even resulting in bankruptcy.

|

|

|

|

|